Over the years, I have discussed the significance and rationale behind financial modeling standards, as well as general spreadsheet design. I also offer a mini course where I provide insights into project finance model design and layouts.

https://hedieh-s-school.thinkific.com/courses/Projectfinancespreadsheetdesign

All of these discussions about model design and structure are the initial steps in preparing the framework of the financial model and lead us to the next significant stage, which is defining the inputs that go into the model.

When you reach the Inputs part of the model, you are entering the Ali Baba cave of probabilities. In a perfect world with free information, for each critical input to the model, you could go to a database and find the unique probability distribution of each input. You could then plug these distributions into the model and run a Monte Carlo simulation to attach probabilities to the results and metrics that you want to present. For example, you might find that with a 50% probability, the equity IRR will be 14%, and with a 90% probability, the equity IRR will be 12%. However, we do not live in such a reality.

Finding even one data point for an input can sometimes be challenging. The best we can do in our models is to define our expected case, the base case, the upside case, and the downside case.

So, the big question is, what is this expected case, and how can we ensure that our expected case becomes a reality? The entire concept of project finance revolves around how we can mitigate the risk if we find ourselves in the worst-case scenario. All legal discussions are conducted with the expectation that things may go sideways and our planning is aimed at securing our funds in such situations. While the legal team works to safeguard the deal against adverse scenarios, the project appraisal team, including the financial modeler, plays a crucial role in ensuring that the Base Case defined in the financial model closely aligns with reality.

Remember, the financial model is used to set tariffs, determine the size of each financing instrument, and structure the debt. All these decisions directly stem from the model. When the future becomes the present, you’ll have the opportunity to test whether your predictions were accurate. Ideally, you’ll encounter some underestimations and some overestimations, and they will balance each other out, allowing the business to run smoothly and according to schedule. However, if the negative impacts of inaccurate estimations (e.g., overestimation of revenues) outweigh the positive impacts of inaccurate estimations (e.g., overestimation of costs), then the project encounters trouble, potentially leading to restructuring.

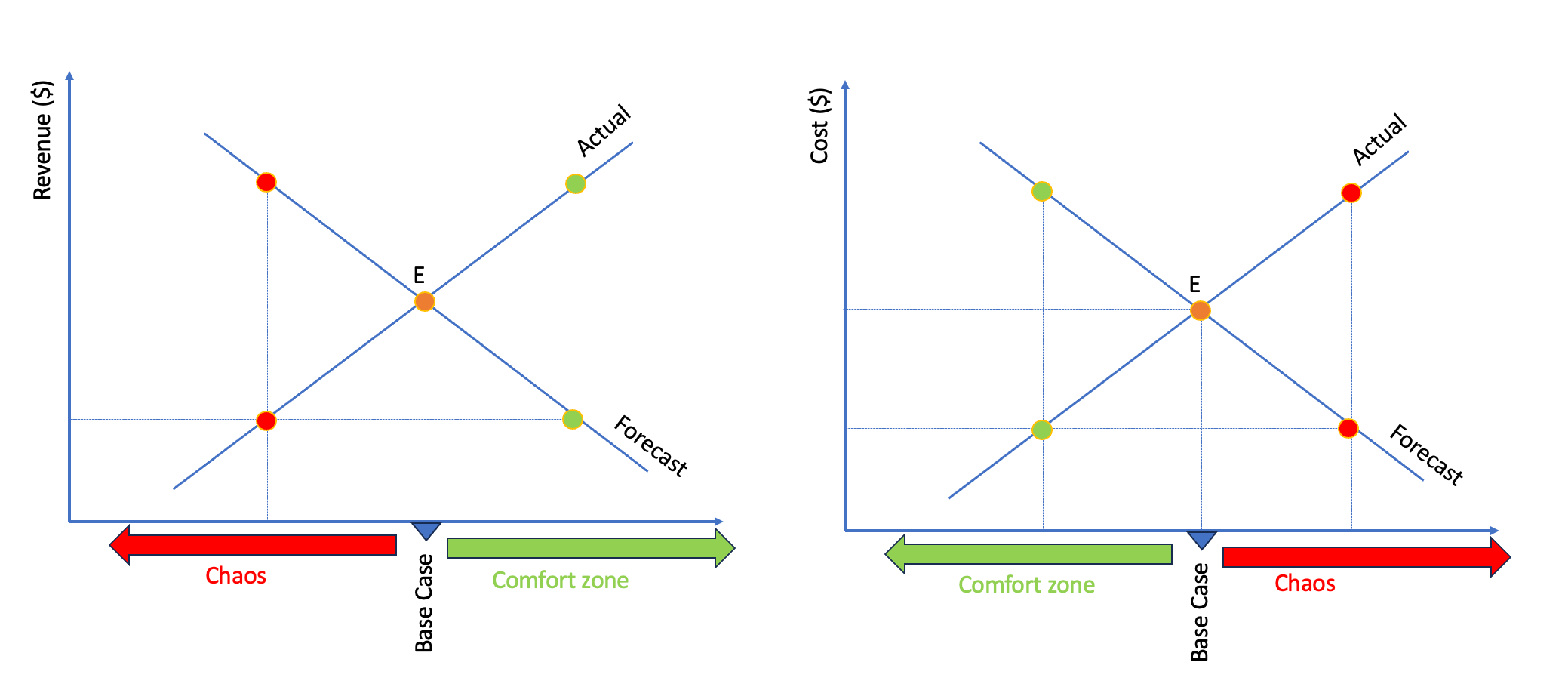

Of course, there are events like pandemics and wars that don’t make sense to include in any base case. You can test the model for ‘what if’ scenarios like a pandemic and apply various sensitivities for delays and cost overruns. However, the base case should represent the equilibrium scenario. It should be the expected case in which you have confidence that it will materialize. Nonetheless, you must acknowledge the risk that betting on the wrong number in your base case could lead to chaos.

This is precisely what lenders seek when they review the sponsor’s base case. They assess the financial model provided by sponsors and take the sponsor’s base case as their upside case. They define a more conservative case to ensure that in their analysis, they stay within their comfort zone. This way, even if things go wrong, they aim to end up somewhere close to equilibrium.

Sponsors are more willing to take risks, so they are comfortable sitting at the crossroads and hoping that they have a high chance of following the path that the base case model envisions.

I shared these stories to remind you that when you look at the inputs, you are always walking in the world of uncertainty. You see them as individual data points, but with your human brain, you should be able to see the uncertainties surrounding each input and assign a confidence level to each one. You should also be able to communicate why you have confidence in your base case inputs.

How do you gain trust in your input?

Benchmarking

The best way to give yourself confidence in your inputs is to compare them with other similar projects and make sure that all inputs are within the typical range for similar projects. This can be a good source of information when you are at the early stages of your project and still need the technical studies and contracts to back up your assumptions. Providing that benchmarking exercise as part of your analysis will also show that the contracts you have negotiated are in line with standard practices.

Trends

In corporate finance, most projections are based on past trends. However, in a project finance deal, we don’t always have the luxury of having historical data for all of the parameters. But for some parameters, such as inflation, exchange rates, historical merchant electricity prices (if you are in a merchant market), and natural gas prices, we can still base our assumptions on historical trends. If your project is somehow involved in commodities, you can use this great tool by Professor Bodmer to get historical trends in the main commodities.

Talk to locals

One of my most educational experiences was working as a consultant for the African Development Bank. What was extraordinary was the emphasis that the private sector of the bank was putting on analysis at the time I was serving there. As the financial modeler, I had the opportunity to travel to the project site with the other team members on site missions. I had the chance to talk to people working at the special purpose vehicle (SPV) and cross-check the construction budget with them. When you know people who are working on the project company, have seen their offices, and have a better understanding of what the SPV budget should be during construction, you can make more informed assumptions in your financial model. So, discuss your assumptions with people who have a hand in the business, regardless of their position.

Expert opinions

One inevitable component in any project appraisal is the budget allocated for various advisors. These advisors play a crucial role in identifying most of the parameters included in the base case. Initially, sponsors engage their legal, technical, financial, tax, insurance, environmental, and other advisors to prepare the project appraisal documents. Subsequently, when lenders become involved, they also enlist their own advisors to independently review the work conducted by sponsor advisors. While the involvement of these multiple advisors may slow down the process, their collective effort ensures that our future expectations align as closely as possible with the actual outcomes, ultimately defining the base case.

Update Regularly

Defining a base case is not a one-time task; it’s an ongoing process that demands vigilance and adaptability. As you progress through your appraisal, the need for regular updates to your base case becomes evident. Keeping a watchful eye on macroeconomic data is essential, as it can directly impact your assumptions. Economic conditions change, interest rates fluctuate, and market dynamics evolve, making it crucial to stay in tune with these shifts.

For instance, the direction in which interest rates are trending can significantly affect your financial model. If you notice interest rates are changing, it’s vital to revisit and potentially revise your hedging strategy accordingly. This adaptation is not a mere formality but a necessary step to ensure that your model remains in sync with the ever-evolving realities of all project aspects.

Don’t Put a Happy Sticker on a Reality Check

An engine out of fuel will not work even if you put a happy sticker on the fuel gauge. So, strive to stay grounded in reality and reflect that in your projections. Have enough evidence to support your assumptions, but also keep an open mind to changes along the way.

How do you communicate your trust in the validity of your projections in the financial model?

Anyone sharing a financial model with a third party must possess a high level of confidence in their projections to be willing to share their perspective. Those receiving the financial model are naturally inclined to scrutinize the story presented within the base case. As a result, they will question every input that is incorporated into the model.

To streamline the review of inputs, one practical approach is to include a reference sheet within your financial models, providing a point of reference for each input. Going a step further, you can incorporate another sheet labeled ‘Raw Data’ within your model. This sheet can house excerpts from documents, detailed data from benchmarking analyses, and all forms of analysis conducted to ensure your assumptions are substantiated by evidence, reinforcing your confidence in the projections.

Last words

If you’re using the financial model as a decision-making tool and roadmap for your decision-making process, these strategies should come naturally, and you’ll receive guidance from various advisors throughout the project’s life cycle to enhance your projections. The critical point to emphasize here is that you should actively employ the financial model and regard it as a decision-making tool and roadmap for your decision-making process.

Consider this scenario: You’re a financial modeler who believes in the power of the financial model to shape the future. However, you may find it challenging if you’re the sole advocate within your team for regularly updating model assumptions. Gathering data is a collaborative effort that demands commitment from everyone involved in the project.