Introduction

In a project finance deal, the main security for financier is the projected cash flows from the project and lenders who typically finance 70-80 percent of an infrastructure project would like to have full control over what goes in and out of the project’s account. That is why various accounts will be set up prior to financial close between the borrowers and the lenders to ensure that project cashflows are appropriately managed.

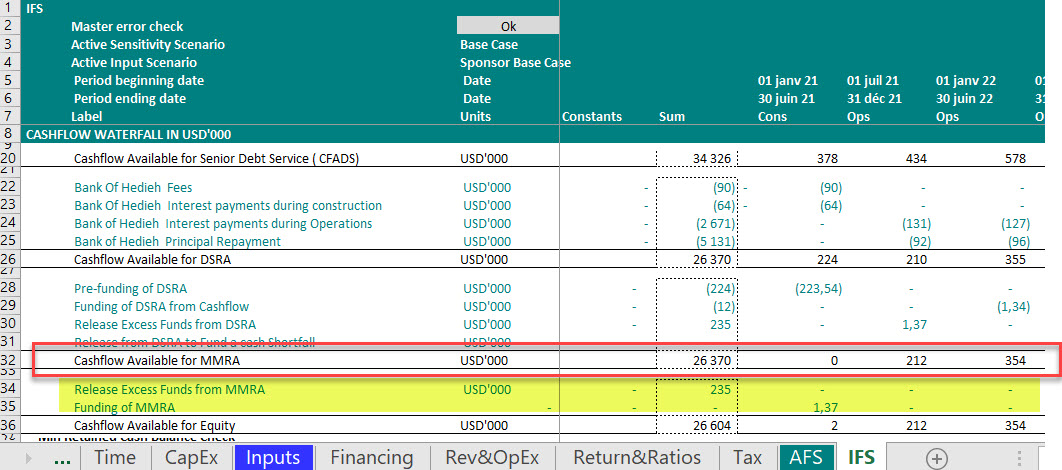

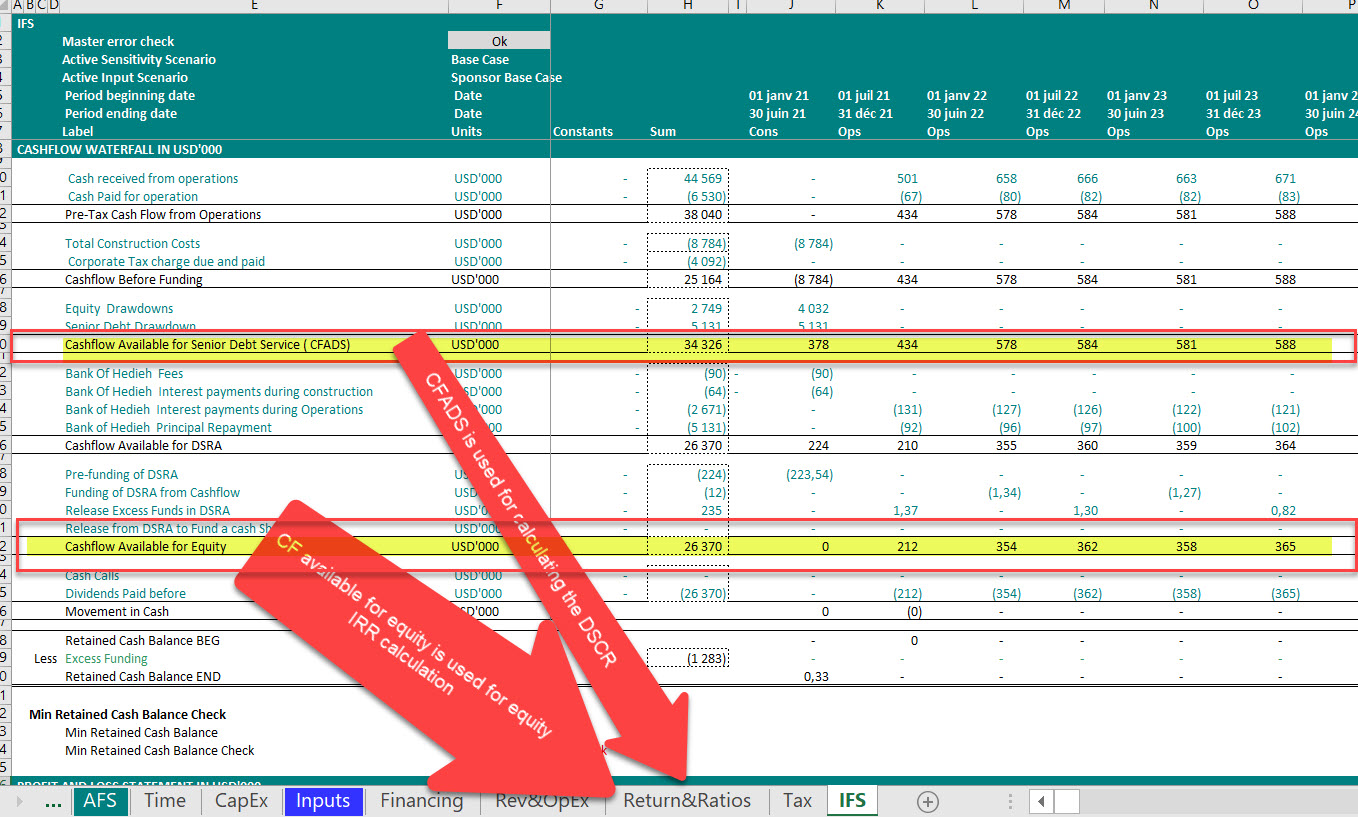

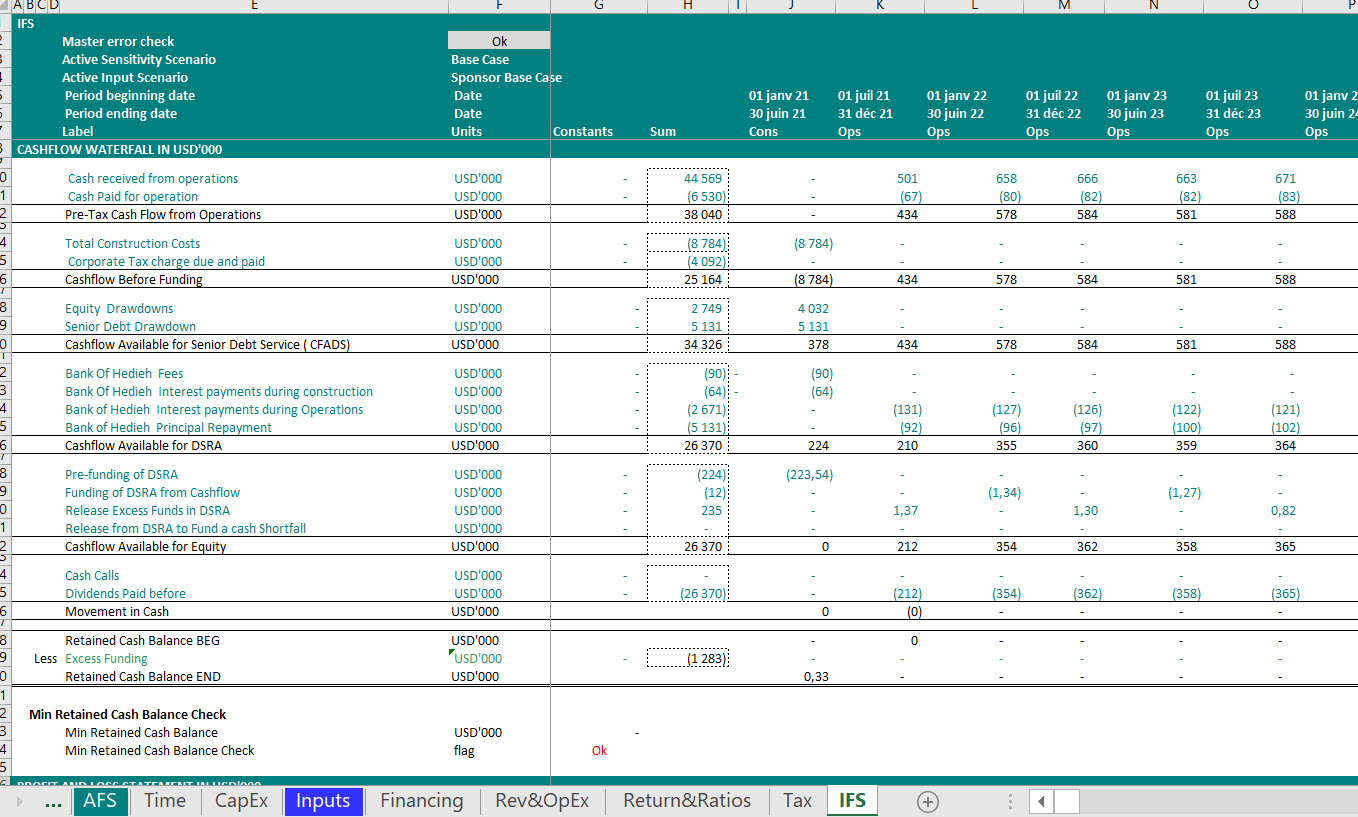

During the loan term sheet negotiation, all the accounts that needs to be opened and managed by lenders will be set out in the term sheet or in a separate agreement sometimes called “Accounts Agreement”. In addition, the term sheet will specify the seniority of each cash flow item which is called a Waterfall. The cash flow waterfall statement is also one of the main financial statements to be included in the project finance model and all return and debt ratio calculation will refer to the cash flow waterfall.

Definition

The cash flow statement is a financial statement that summarizes the amount of cash inflows and outflows of a company/project.

+

Waterfall is a cascade of water falling from a height, formed when a river or stream flows

—————————————————————————————————————————————————————————————-

The cash-flow waterfall also known as cash-flow cascade sets out the order of priorities for the use of cash inflows (revenues) earned by an SPV. Meaning that as soon as the project starts generating cash, lenders would monitor how the cash is spent and at which order. So basically you give a ranking to each of the cash outflows and based on the ranking they will be prioritize when the SPV want to pay its expenses.

Why it is needed?

As mentioned in the introduction, in a non-recourse financing transaction, lenders want to make sure that their loan is repaid before any payment to any junior lenders and shareholders. Therefore, they contractually document in their term sheet what can be paid out before the debt service is due and what would be subordinated to payment due to lenders.

These terms and provisions are mainly destined to protect against down case scenarios. Meaning that when things are going as expected, there are no issues and there will ne enough cash in the project account to pay for operating expenses, pay taxes, pay lenders and also remunerate shareholder. These stakeholder will be all paid out based on the order defined in the cash flow waterfall. When things go wrong and then every drops count and the order in which the money is paid out becomes important. Equity being subordinated to debt service means that if things go wrong equity is more at risk than debt. There might be enough cash in the pay for taxes, operating expenses and debt service but no cash available equity. In this circumstance the cash flow waterfall will ensure that this seniority is taken into consideration in each model period.

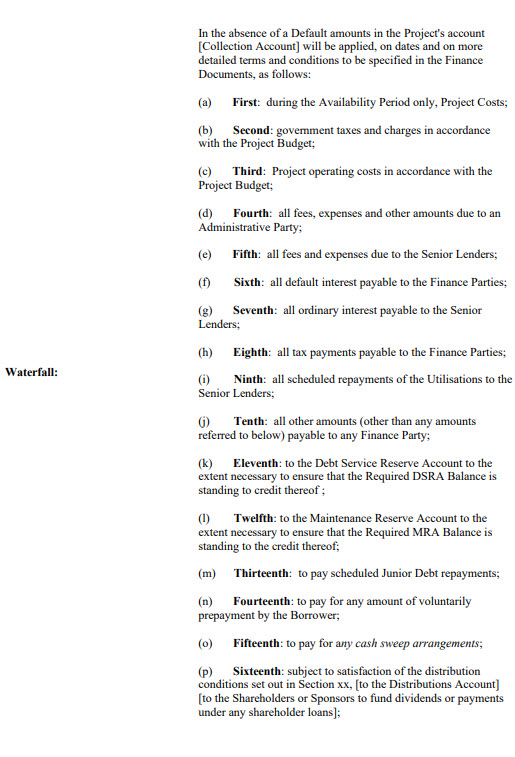

The typical order in a cash flow waterfall statement

- Project operating costs and taxes

- Fees and expenses

- Interest payable to finance parties

- Scheduled principal repayments

- Funding of debt service reserve account

- Funding of maintenance reserve account

- Funding of any other reserve accounts

- Distribution to investor

Is it a contractual obligation?

Yes, the “Cash flow Waterfall” or “Cash Cascade” is documented in the term sheet (either under definitions or a dedicated section in the loan agreement) and lawyers will be involved in drafting of the definition of a waterfall. Also the waterfall will have to be reflected in the financial model as part of the 3-way integrated financial statements (Profit & Loss Statement, Balance sheet and Cash flow waterfall statement”.

How about the Cash flow waterfall during construction? Do I necessary need to model it?

In a project finance type of transaction, a project will be cash negative during construction and the project costs will be funded with debt and equity. The drawdown schedule under debt and equity will extensively documented in the term sheet and parties will use the Sources and Uses of Funds statements for monitoring the drawdowns. Therefore cash flow waterfall during construction is as Yescombe puts it “largely dormant” during construction.

In terms of the financial model, you should make sure to have a detailed and periodic sources and uses of funds statement covering the drawdown/construction period. As for the cash flow waterfall, it is mostly included as part of the 3-way projected financial reports in period and also on annual basis.

What are the common points of negotiations within lenders and sponsors when it comes to Cash-flow waterfall?

Of course it is project specific and every project has it’s own specificities. However one of the generic topics are:

-

Management fees

One of the main task of model auditors is to go through the project operating budget and question costs that they might be categorized as equity remuneration and therefore would fall in the category 8 rather than category 1 in the typical ranking mentioned above.

-

Insurance fees securing equity

Any kind of equity based insurance product that is meant to benefit the shareholders will be a subject of discussion with lenders. Some lenders allow these fees to be included as part of the SPV cost as Opex, others might accept these fees as SPV costs but subordinated to debt service and in some cases, lenders might not allow these fees to be as part of the SPV costs and enforce the shareholders to pay them on their hold-co level. In this case, these cash outflows will not appear in the cash flow waterfall statement and will only affect the equity return.

-

Fee for a Letter of Credit tided to equity

Project finance transaction being by nature non-recourse there’s not much security required by shareholder. However, lenders typically require some sort of guarantee for the equity option of the financing package. Lenders might require a guarantee that the unfunded contingency is going to available if needed and for that they might by an LC. Sometimes lenders require the unfunded equity to be available couple of years post construction so then in that case who is going to pay for this and where it’s fall in the waterfall is a topic of discussion.

-

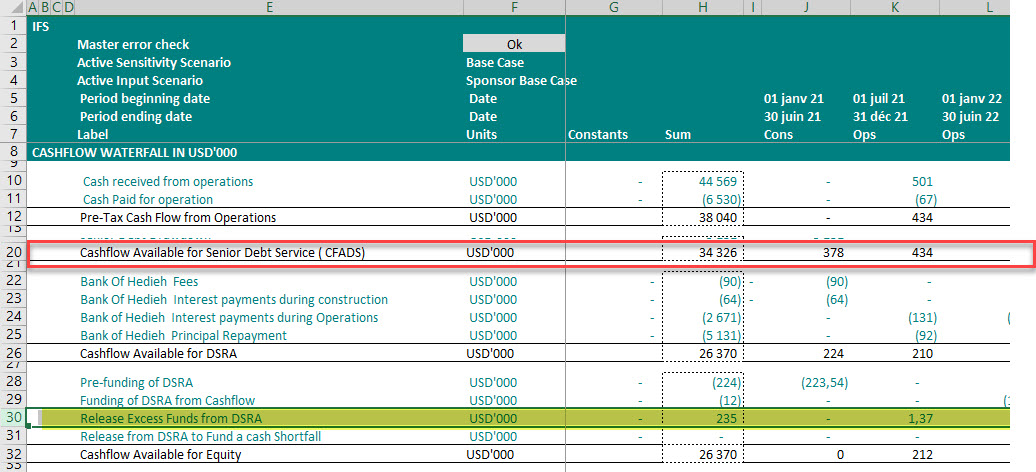

Funding of and release from Debt Service Reserve account

In a project finance deal, lenders typically require the establishment of a reserve account to cover the upcoming debt service. The balance of this account needs to maintained throughout the life of the loan. Lenders might allow excess cash from this account to be released in the cash flow. Now the questions is whether the release from DSRA can be included in the cash flow available for debt service? I have seen both yes and no in different deals. Just note that this can be a subject of negotiation. The funding of DSRA is almost all project is subordinated to debt service.

-

Funding of and release from maintenance reserve account

There are projects that require a large maintenance costs at certain periods in the life of the project. In those circumstances, lenders might require the establishment of an account that accumulates funds and release them when they are needed. The order of the funding and release from this account is also a subject of discussion. One might argue that funding of MMRA should be ranked before debt service but typically it is subordinated.

If you are building a financial model…

If you are building a financial model for a project finance transaction, first ask if there’s already a term sheet with lenders. In project where you have a group of lenders, you might have a Common Terms Agreement (“CTA”) and you can find the definition of waterfall in this document. If an agreement is not available then you have to build a cash flow waterfall from the point of view of the institution that you are representing. If you are from the lenders side, you rank cashflow items based on what is in favor of lenders, and if you are representing the sponsors then you represent shareholder’s point of view and you leave it to the negotiation table to finalize the ranking. This is important for everything that goes into the model. Your financial model should reflect your point of view, and should be flexible enough to accommodate other paries point of view.

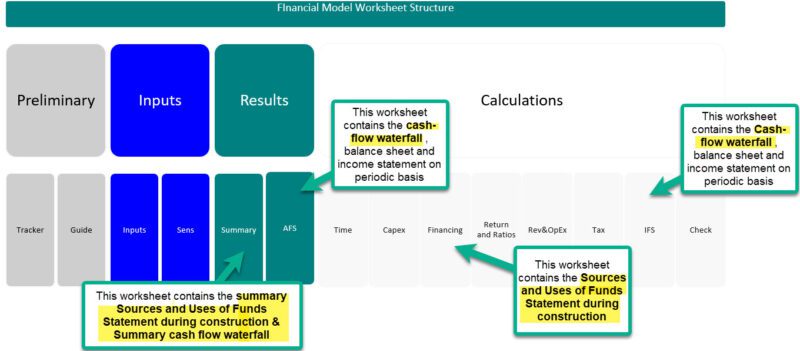

Where can I find the cashflow waterfall in a typical project finance model?

In most standard financial models, you have a dedicated sheet reporting the 3 projected financial statements and cash flow waterfall should be among one of the three (Project & Loss statement, Balance sheet and Cash Flow Waterfall).

The calculation of the main project metrics like debt metrics (min Debt Service Cover ratio, Loan life-cover ratio, etc.) and equity metrics (Equity IRR, payback period, etc.) are linked to the cashflow waterfall statement.

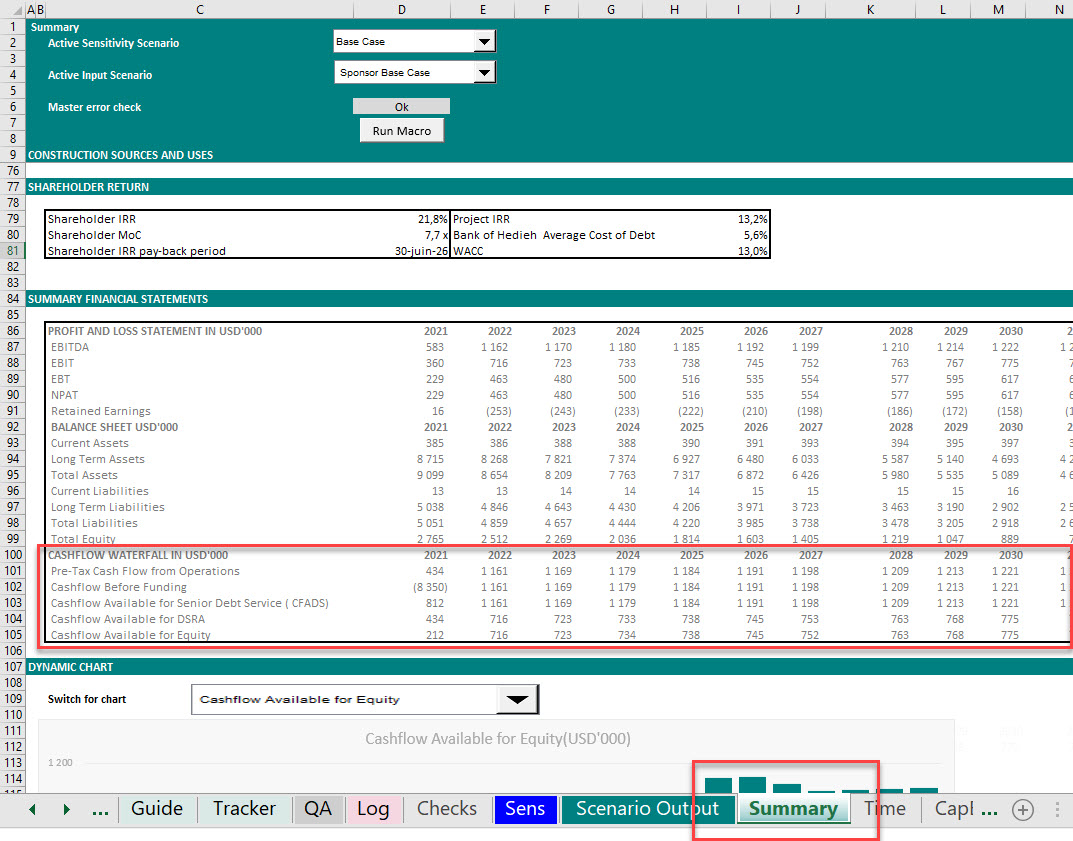

Summary annual cashflow waterfall to be included in the Summary/Dashboard sheet

In your summary sheet, add a subsection labeled “Summary Financial Statements” and add the key lines from your annual statements in form of a

table like the below table:

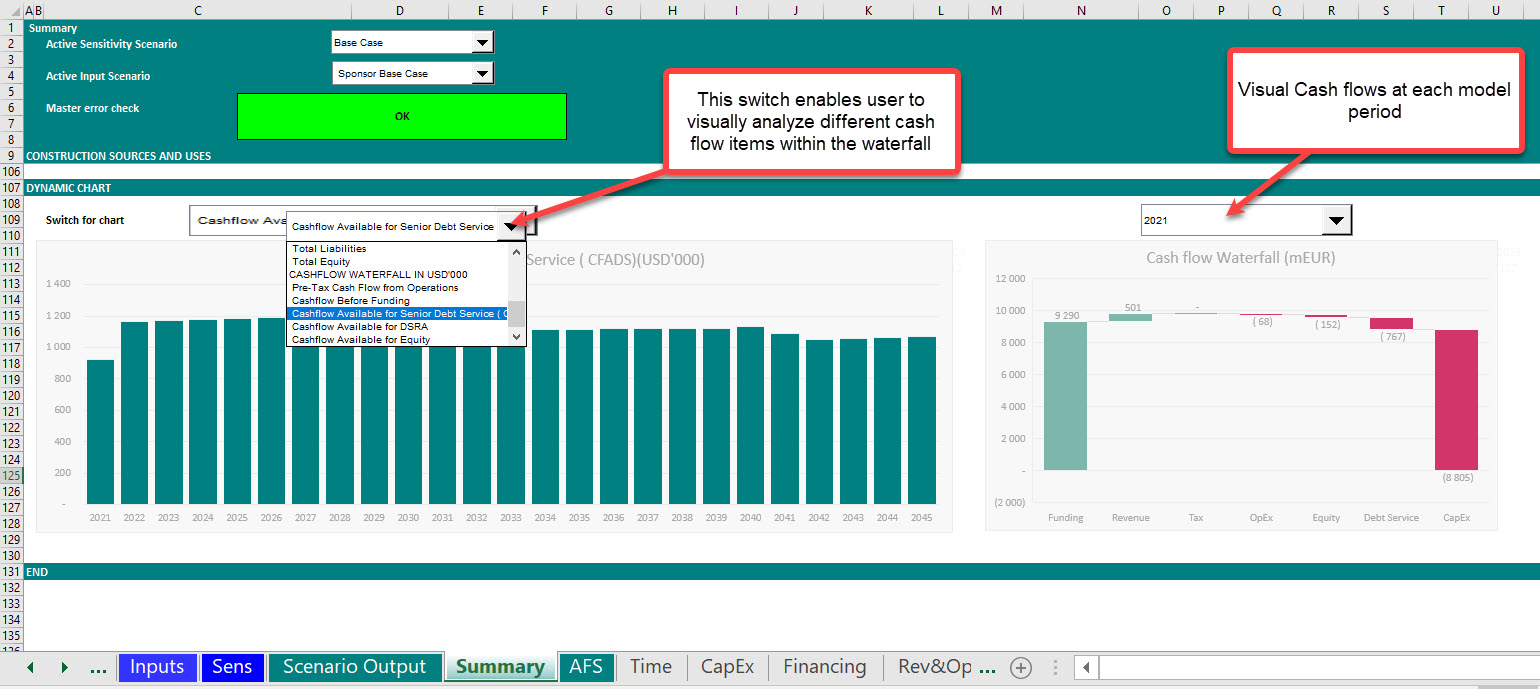

Suggested Charts Cash flow waterfall visualization

In addition to the summary financial statements and cash flow waterfall to be included in the summary sheet, it might be valuable to offer the possibility to users to visually analyse the cash flow trend using dynamic charts. Here are my suggestions:

-

Visualize Financial Statement with Dynamic Charts: Include a dynamic chart that enables user to switch in between different cash flow items and switch in between different cash flow items using a switch

- A waterfall chart enabling the visualization of cash flow waterfall at each model date (I prefer using the annual flows)

Cash flow waterfall Base Case model Check

Link to model integrity Checks

Example extracted from a Project Finance Model

Example extracted from a term-sheet