Question: When do we decide whether to adopt or rebuild a project finance model and who makes that decision?

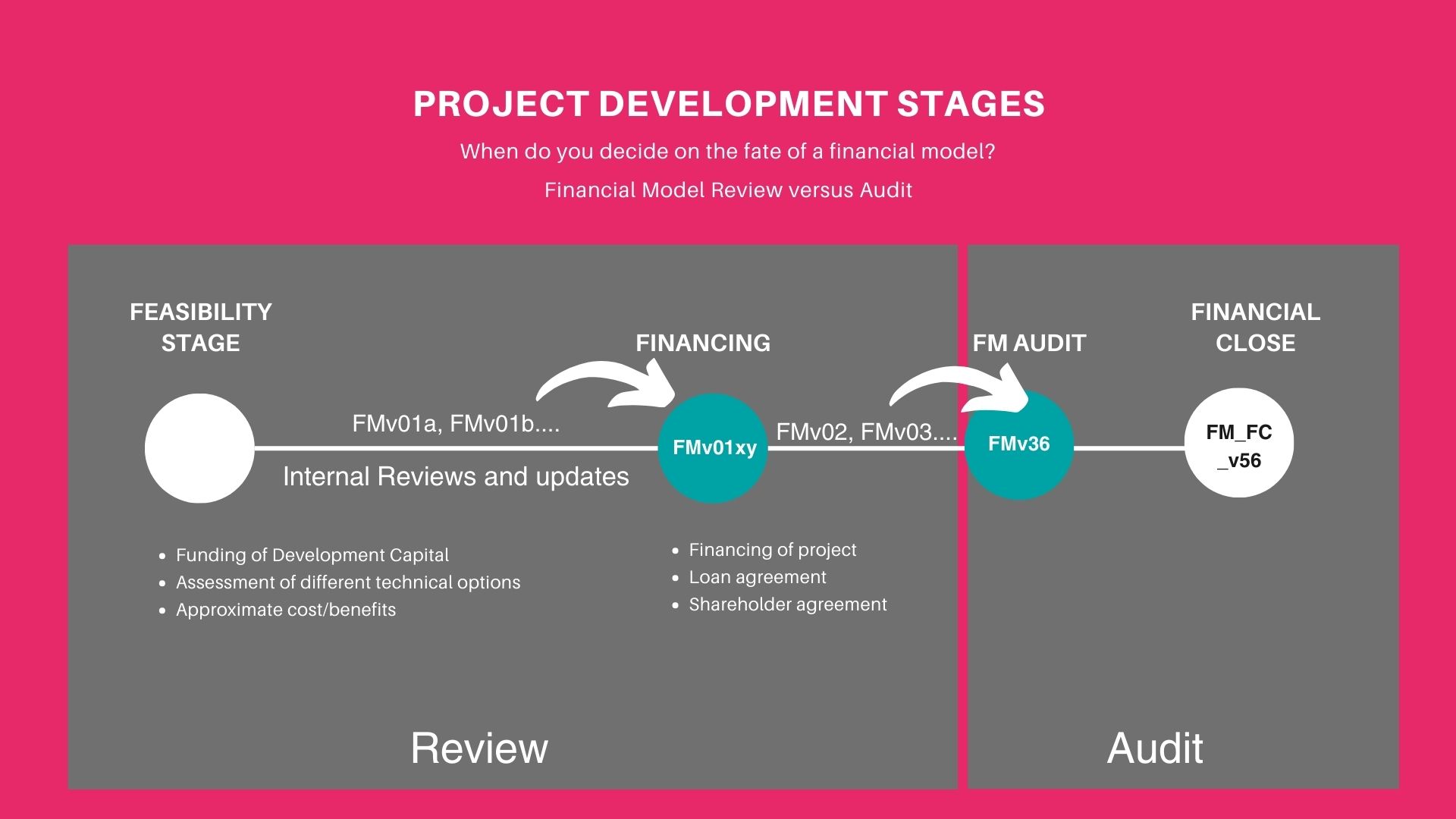

To answer this question, we need to look at a typical project lifecycle.

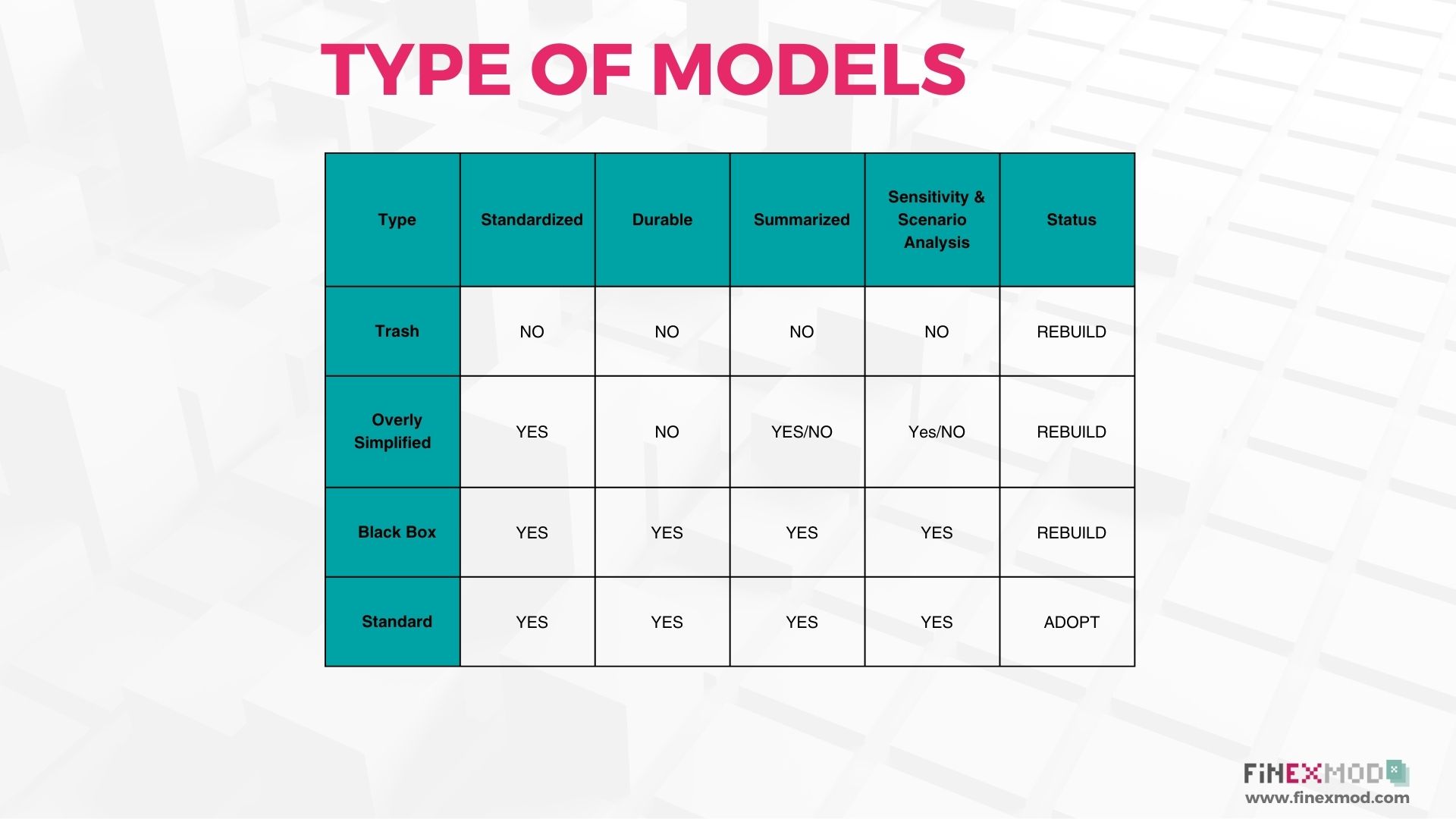

A project developer has a project in mind (Idea stage) and has collected data and will want, at the early stage of development, to know whether the project is profitable and the expected return. So, the developer either uses a template or builds a model from scratch at this stage for the initial analysis. Depending on the financial modeling capabilities of the developer, the model can be simple, complex, or a standard financial model.

Without external review, no one will judge the model, and the developer will continue their development activities. Suppose the developer decides to get a co-developer either to raise additional development capital or to compensate for the lack of expertise; for example, a developer might have great technical capabilities but lacks financial advisory. In that case, that developer can either hire a financial advisor or team up with a developer with financial expertise. Then, the co-developer will ask for the project documents, and the financial model is part of the checklist. This is the first round of external financial model review, and the co-developer can decide on the quality of the model. Then, once the model mechanics are fixed, the developer will use the financial model to negotiate contracts. So, they might use the financial model to negotiate project tariffs, and there might be another round of financial model review. For example, in a utility-based power project, they might send the model to the utility to negotiate the tariff on an open-book basis. So, the utility will also review the model and will have a say on the model mechanics and, of course, assumptions.

At the financing stage, where the developers start contacting debt and equity providers, both these stakeholders, and especially lenders, will review the model mechanics and assumptions, and they might decide that the model is not fit and is not based on their standards and has to be rebuilt from scratch. No matter how much time and money has been spent on the current version of the model, if the lenders think that the model is not fit, it should be rebuilt from scratch. After the lender review, an external auditing company will audit the agreed model as part of the lender’s due diligence process. This process typically starts 3 to 6 months before the expected financial close date. The final model audit report should be available at the signature date as part of the conditional precedents to financial close. As you can see, given the timing of when the auditors get involved, auditors rarely result in a complete rebuild of a financial model.