This is the first post in a series of posts on Concessional financing in a project finance transaction.

Episode 1: Definition and types of concessional funding

Episode 2: How to model it? Inputs required and timing of grant injection

Episode 3: Scenario analysis: Grant and impact on equity IRR

Episode 4: Scenario analysis: Grant and impact on tariff

Introduction

In today’s dynamic economic landscape, understanding various sources of finance is crucial for project success. As we navigate the complexities of inflationary environments and fluctuating interest rates, exploring alternative, cost-effective financing options becomes imperative. In this blog post, we’ll delve into the world of concessional funding and grants, shedding light on their significance in project finance.

The Importance of Cost of Capital:

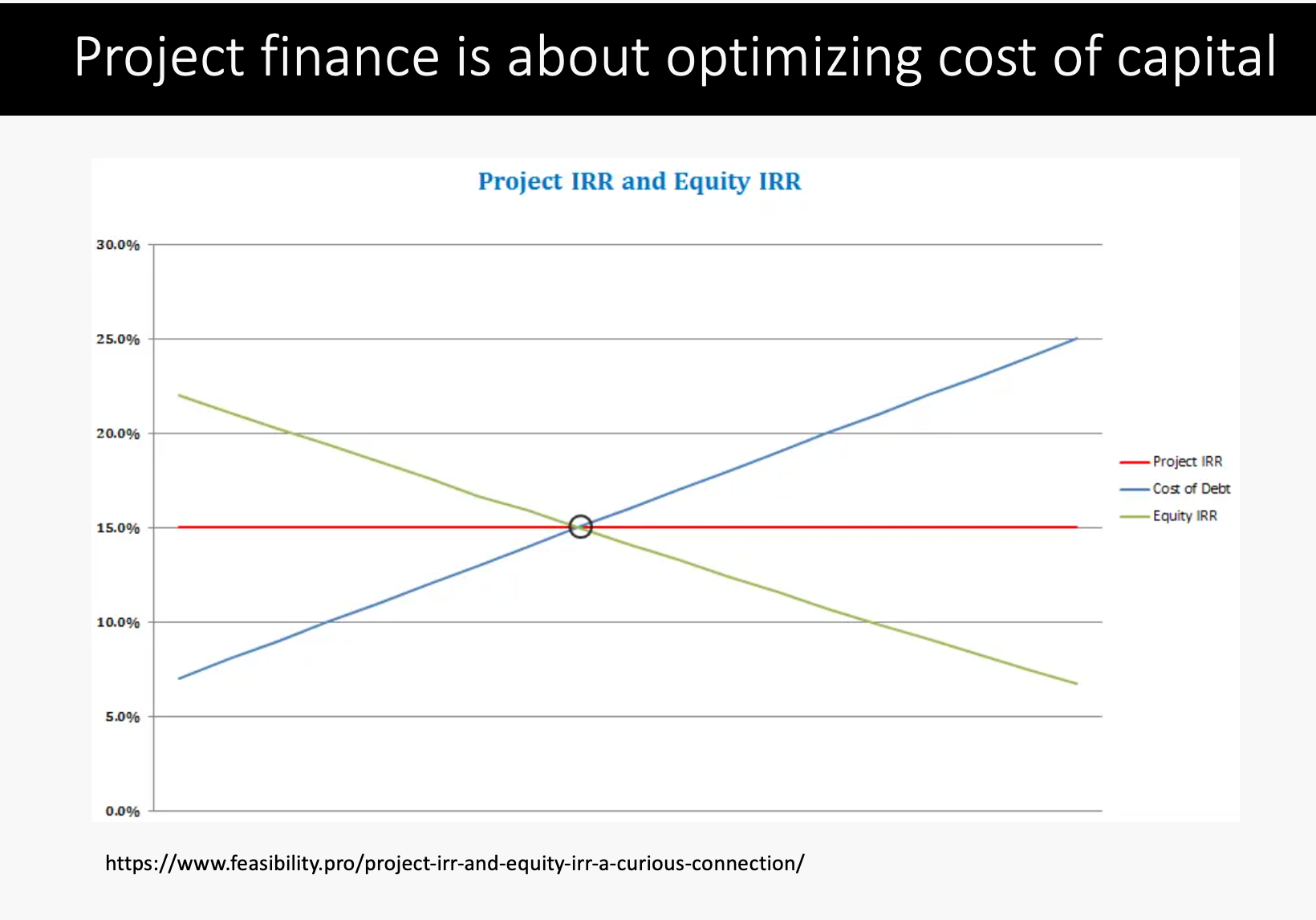

Before diving into concessional funding, it’s essential to grasp the role of the cost of capital in project finance. The project’s Internal Rate of Return (IRR) represents its operational return, independent of financing. It’s essentially the revenue minus capital expenditures (CAPEX), operating expenses (OPEX), and other operational adjustments. Conversely, the cost of capital reflects the interest rate investors or developers can secure in the market.

In project finance, the sweet spot is where the project IRR exceeds the cost of debt. If the cost of debt surpasses the project IRR, it’s not conducive to use project finance, as the core principle is to leverage cheaper debt.

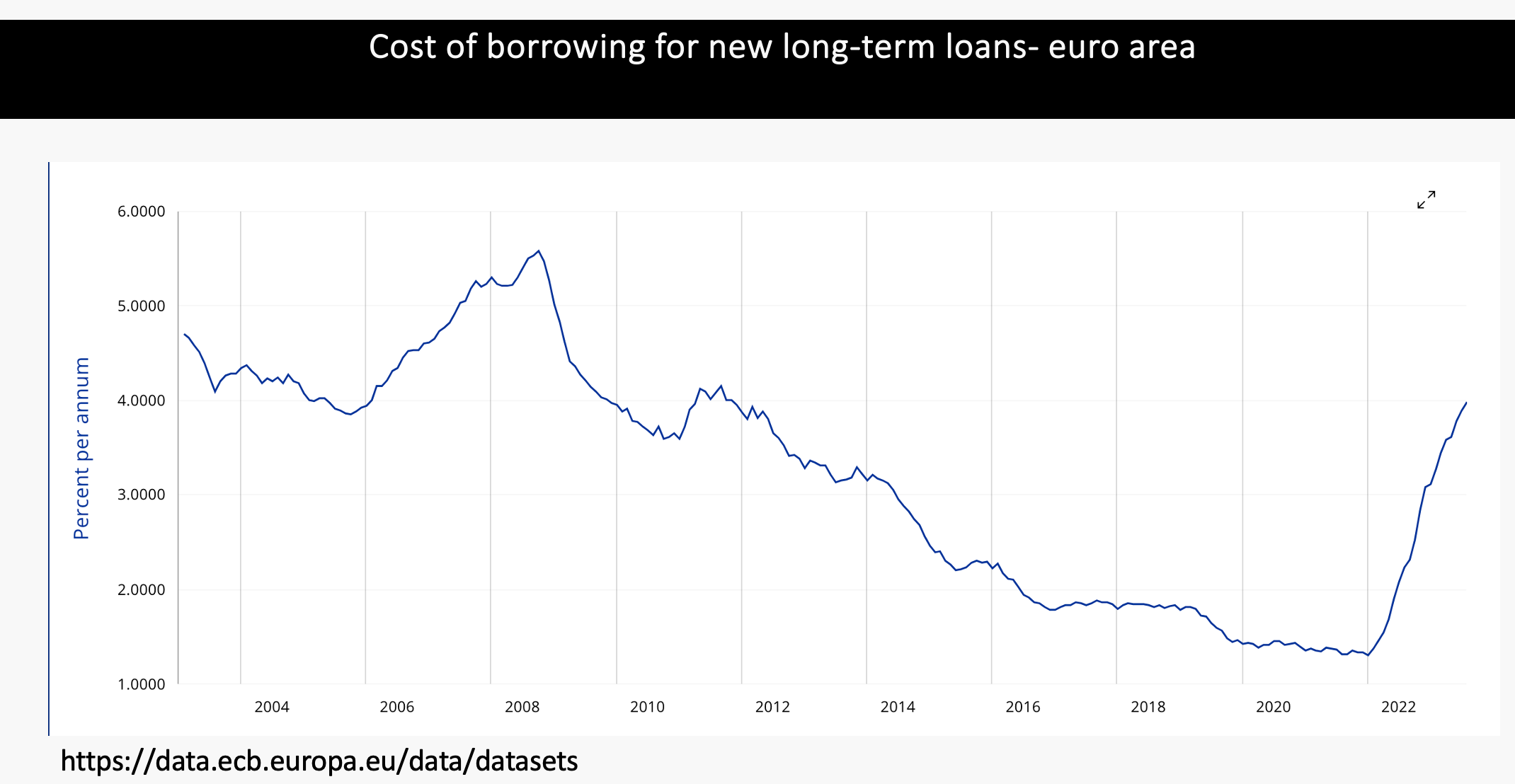

Recent years have witnessed spikes in interest rates, making it increasingly challenging to secure project financing, especially in developing countries perceived as high risk by rating agencies. With banks charging higher margins and base rates like Libor or Euribor, it has a significant impact on project funding. In such scenarios, considering concessional funding and cheaper sources of finance becomes a compelling option to attract private investors.

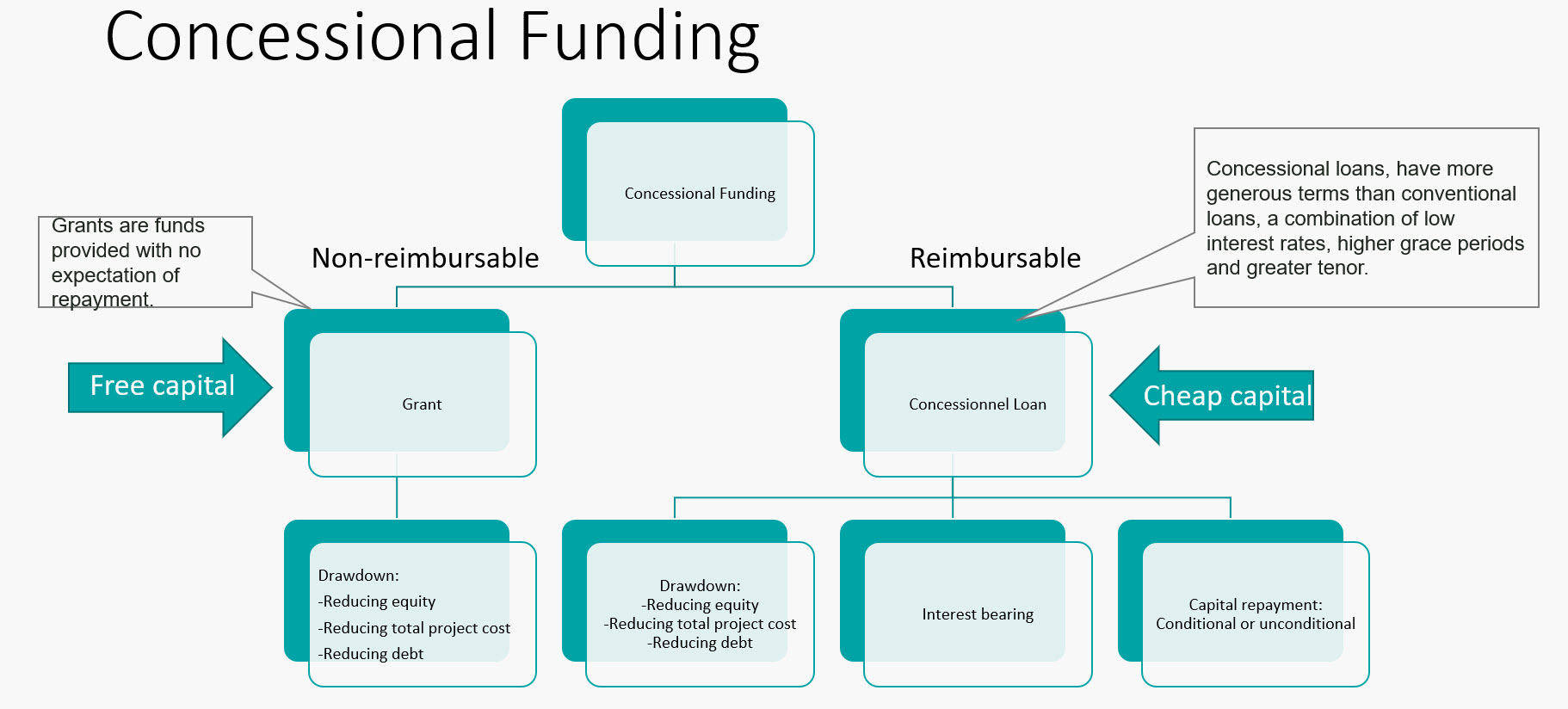

What is concessional funding?

- Concessional funding sources are some sort of support in the form of a free or cheaper source of financing

- Provided by major financial institutions, such as development banks and multilateral funds, to developing countries to accelerate development objectives.

- Concessional Funds are limited

- Considerable competition

- It might be limited to specific countries

- Some donors or agencies limit concessional funding for specific equipment or specific studies (i.e., funding technical assistance)

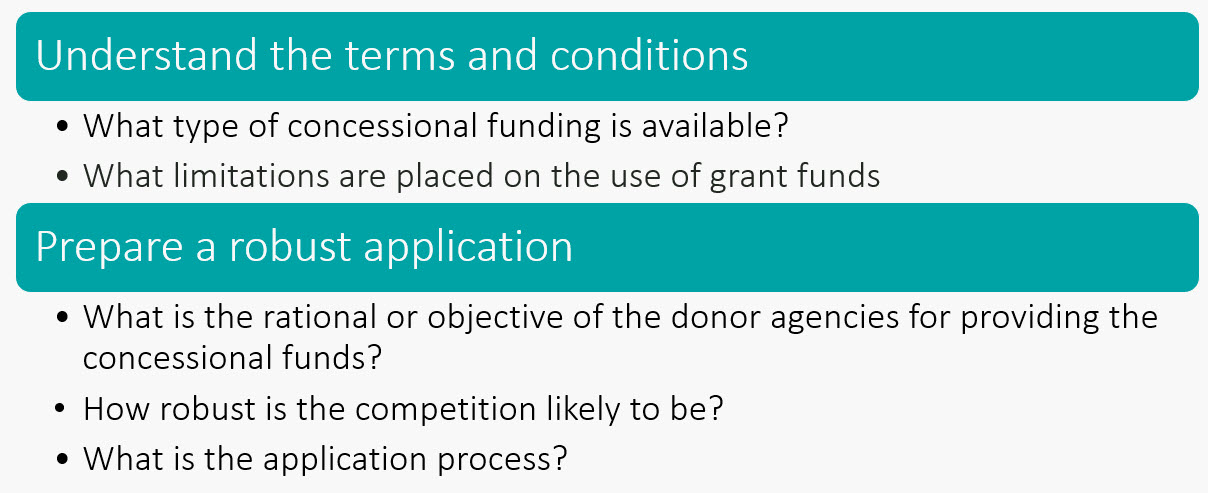

Things to consider when applying for concessional funding?

When drafting a financial proposal for a grant, you should keep in mind that your proposal should be clear, concise, and well-organized. Here are some key steps to follow:

- Identify the project budget: Before drafting your financial proposal, you need to have a clear idea of the total budget required for your project. This should include all the necessary expenses, such as salaries, materials, equipment, travel, and any other costs associated with implementing the project.

- Outline the funding request: In your financial proposal, clearly state the amount of funding you are requesting and how the funds will be used. Be specific and provide a detailed breakdown of the expenses that the grant funding will cover.

- Provide a budget summary: Include a summary of your project budget that provides an overview of the total project costs, the requested grant amount, and any other sources of funding that you have secured.

- Detail the budget breakdown: Provide a detailed breakdown of the project budget, including all expenses that will be covered by the grant funding. Categorize expenses by types, such as personnel, materials, equipment, travel, and indirect costs. For each category, provide a description of the expenses and the estimated costs.

- Include a budget justification: Provide a justification for each expense listed in the budget breakdown. Explain why the expense is necessary for the project and how it will contribute to achieving the project’s objectives.

- Provide a timeline: Include a timeline for the project, which outlines the expected start and end dates for each phase of the project. Use the timeline to illustrate how the grant funding will be used over the course of the project.

- Review and refine: Review your financial proposal carefully, ensuring that it is accurate, complete, and well-organized. Refine as necessary to ensure that it effectively communicates the financial aspects of your project and the funding request.

By following these steps, you can draft a comprehensive and effective financial proposal that demonstrates your project’s financial needs and its alignment with the grant program’s priorities.

There are various agencies that provide grants for infrastructure projects, depending on the location and type of project. Here are some examples:

- World Bank: The World Bank provides grants and loans for infrastructure projects in developing countries, including transportation, water, and energy infrastructure.

- African Development Bank (AfDB): The AfDB provides grants and loans for infrastructure projects in Africa, including transportation, water and sanitation, energy, and ICT infrastructure.

- United States Agency for International Development (USAID): USAID provides grants and technical assistance for infrastructure projects in Africa, including energy, water and sanitation, and transportation infrastructure.

- European Union (EU): The EU provides grants and loans for infrastructure projects in Africa, including transportation, energy, water, and ICT infrastructure.

- Japan International Cooperation Agency (JICA): JICA provides grants and loans for infrastructure projects in Africa, including transportation, energy, water, and ICT infrastructure.

- China Development Bank (CDB): The CDB provides financing for infrastructure projects in Africa, including transportation, energy, and telecommunications infrastructure.

- Islamic Development Bank (IDB): The IDB provides grants and loans for infrastructure projects in Middle Eastern countries, including transportation, water, and energy infrastructure.

These are just a few examples of agencies providing grants for infrastructure projects, and there may be others depending on the specific location and type of project.

Conclusion:

Concessional funding and grants are valuable resources in the world of project finance, particularly in challenging economic environments. While they offer cost-effective financing, applicants must carefully navigate the competitive landscape and adhere to donor agency requirements. By understanding the nuances of concessional funding, project developers can access the funds they need to bring their projects to fruition, contributing to economic growth and development.

Stay tuned for our next blog post, where we’ll explore how to integrate grants and concessional loans into a project finance model. Thank you for reading, and I look forward to seeing you in my next installment. Goodbye!